Discover the top 10 simple and effective ways to save money every month and improve your financial health without sacrificing your lifestyle.

Saving money is essential for financial security and achieving long-term goals. By making small changes in daily spending habits, you can reduce expenses and increase your savings effortlessly. Here are the top 10 practical ways to save money every month.

1. Create a Budget

A budget helps track income and expenses, ensuring you spend within your means. Categorize your expenses and set spending limits to avoid unnecessary costs.

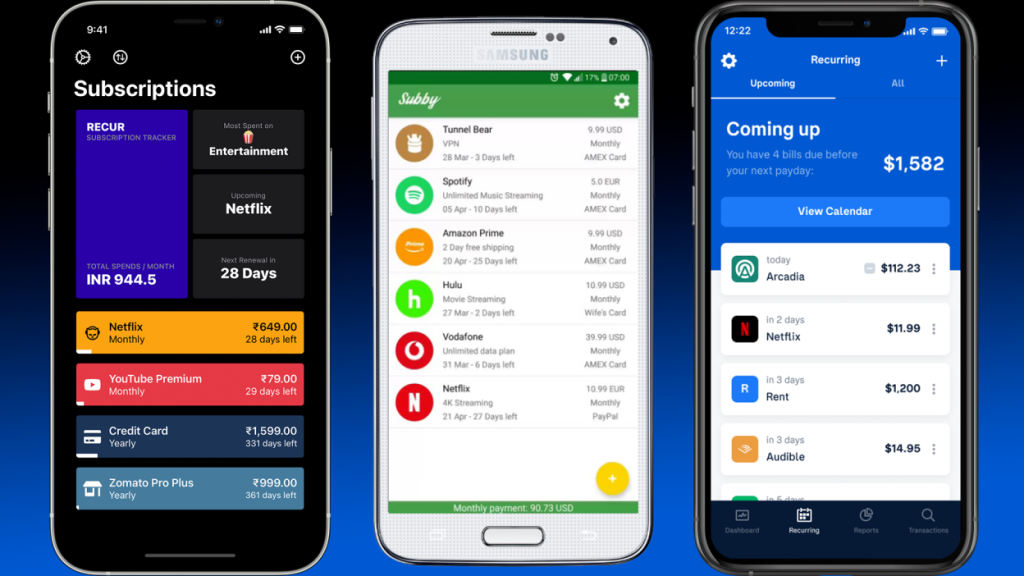

2. Cut Unnecessary Subscriptions

Cancel or downgrade unused subscriptions, such as streaming services, gym memberships, and magazine subscriptions. Only keep the ones you use regularly.

3. Cook at Home

Eating out frequently can be expensive. Preparing meals at home not only saves money but also allows you to eat healthier and control portion sizes.

4. Use Cashback and Discount Apps

Leverage cashback and discount apps to save on groceries, dining, and shopping. Many stores offer loyalty programs that provide additional savings.

5. Reduce Utility Bills

Save on electricity and water bills by turning off lights, using energy-efficient appliances, and limiting water wastage. Small changes can lead to big savings over time.

6. Buy in Bulk

Purchasing non-perishable items in bulk can save money in the long run. Look for wholesale deals on household essentials and groceries.

7. Use Public Transport or Carpool

Reduce fuel and maintenance costs by using public transport, carpooling, or biking. This not only saves money but also reduces your carbon footprint.

8. Avoid Impulse Buying

Plan your purchases and stick to a shopping list. Avoid impulsive purchases by waiting 24 hours before buying non-essential items.

9. Pay Off High-Interest Debt

High-interest debt, such as credit cards, can eat into your savings. Pay off outstanding balances as soon as possible to avoid accumulating interest.

10. Automate Savings

Set up automatic transfers to a savings account each month. Treating savings like a fixed expense ensures you consistently put money aside.

Conclusion

Saving money every month doesn’t require drastic lifestyle changes. By making conscious spending decisions and prioritizing savings, you can improve your financial well-being and work toward your financial goals. Start implementing these tips today and watch your savings grow!